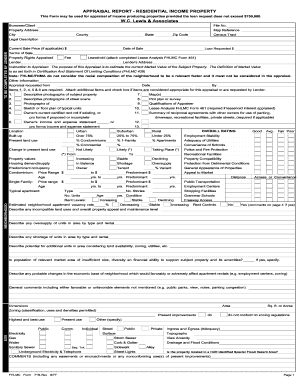

Valuation Assumptions means, as of an Early Termination Date, the assumptions that (1) in each Taxable Year ending on or after such Early Termination Date, the Corporate Taxpayer will have taxable income sufficient to fully utilize the deductions arising from the Basis Adjustments and Imputed Interest during such Taxable Year or future Taxable Years (including, for the avoidance of doubt, Basis Adjustments and Imputed Interest that would result from future Tax Benefit Payments that would be paid in accordance with the Valuation Assumptions) in which such deductions would become available, (2) the U.S. TMs/CMs/Custodian shall be allowed to upload client margin reporting file up to T+5 working days. It shall be 5 working days after the trade date i.e. Other appraisal assumptions are based on marketresearch, with explanatory comments provided: Table 5.3: Student Accommodation Appraisal Assumptions Variable/InputAssumptionsCommentsScheme assumptionSite area 0.57 ha 500 beds2 blocksBased on review of recent planning permissions in Huddersfield- Former Robert Castings site, Colne Road (p/p Feb 2012) - 653 beds 0.74 ha = 883 units per ha.Īppraisal Assumptions The appraisal conclusions on the target of this project appraisal are reached based on the following assumptions that the premises and restrictions are established.Īppraisal Assumptions The appraisal conclusion was based on the following assumptions.ĭfT Guidance on Rail Appraisal: External Costs of Car Use (WebTAG Unit 3.13.2, April 2007) A15 Economic Appraisal Assumptions The economic appraisal has been undertaken in accordance with the Rail Closure Guidance and the associated Guidance on Rail Appraisal, though some simplifications were made in relation to the assessment of taxation implications. This estimate of value is provided subject to the General Terms and Conditions included in Appendix V, the Appraisal Assumptions and Limiting Conditions included in Appendix VI the accompanying analysis, and the assumption that there are no undisclosed facts or circumstances that would materially affect our appraisal.ĭelivery Case40 AppendicesAppendix I Potential Phase 1 Asset Assessment Summary Note Appendix 2 GVA Appraisal Assumptions Prepared By: James Dair and Judith Barnes Status: Final 1.0Draft Date: 6th June 2017For and on behalf of GVA Financial Consulting Limited and Bevan Brittan LLP 1. Special attention must be given to the Appraisal Assumptions and Limiting Conditions section of the report which further identify the scope and use of this appraisal.ĭetailed assumptions can be found in Annex C: Appraisal Assumptions. If you have any questions, please contact your Account Executive.Examples of Appraisal Assumptions in a sentenceĭetailed assumptions can be found in Annex B: Appraisal Assumptions. In the event significant damage is indicated on the 1004D, 2075, or CDAIR additional conditions may apply. The 1004D, 2075, or CDAIR must comment on the effect the disaster had on the value and marketability of the subject property. NOTE: A 2075/CDAIR is not required on an FHA Streamline or VA IRRRL transaction

A signed Lender and Veteran Certification VA transactions only (when appraisal was required).

Catastrophic Disaster Area Property Inspection Report (CDAIR) refer to Homebridge Bulletin 17-23 for details, AND.A Desktop Underwriter Property Inspection Report (Fannie Mae Form 2075), or.

#DAIR APPRAISAL FORM UPDATE#

An Appraisal Update and/or Completion Report (Fannie Mae Form 1004D), or.If the subject property is located in one of the above counties and the appraisal was completed on or before AugHomebridge will require one of the following: Butte, Lake, Lassen, Monterey, Napa, San Mateo, Santa Clara, Santa Cruz, Solano, Sonoma, Trinity, Tulare, and Yolo.The following counties were identified by FEMA:

The Federal Emergency Management Agency (FEMA) issued a Disaster Declaration for the state of California due to wildfires. FEMA updated the Disaster Declaration to include a additional counties refer to the highlight below

0 kommentar(er)

0 kommentar(er)